Unknown Facts About Paul B Insurance Medicare Agent Huntington

Table of ContentsPaul B Insurance Medicare Supplement Agent Huntington Can Be Fun For EveryonePaul B Insurance Insurance Agent For Medicare Huntington Fundamentals ExplainedIndicators on Paul B Insurance Local Medicare Agent Huntington You Should KnowNot known Facts About Paul B Insurance Local Medicare Agent HuntingtonLittle Known Facts About Paul B Insurance Medicare Agent Huntington.

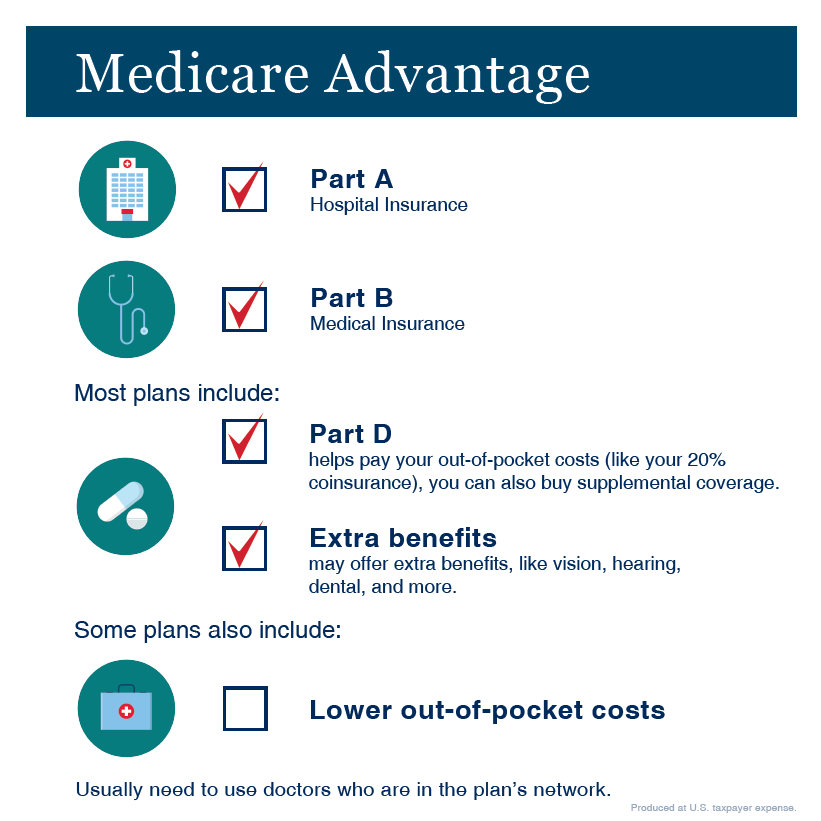

This page includes info on Medicare Part An as well as Medicare Part B qualification as well as enrollment. To learn more about Medicare for individuals that are still functioning, most likely to our Employer web page or I'm 65 and also Still Working web page. Medicare Part A (Healthcare Facility Insurance Policy) and Medicare Part B (Medical Insurance) are readily available to the individuals below: Age 65 or older Impaired End-Stage Renal Disease (ESRD) The majority of people obtain Part A completely free, yet some need to pay a premium for this protection.

Many people pay the complete FICA tax so the QCs they gain can be utilized to fulfill the demands for both month-to-month Social Safety and security advantages and premium-free Part A. Particular Federal, State, and city government staff members pay only the Part A part of the FICA tax obligation. The QCs they make can be used only to satisfy the requirements for premium-free Component A; they may not be used to fulfill the requirements for monthly Social Protection advantages.

How Paul B Insurance Medicare Health Advantage Huntington can Save You Time, Stress, and Money.

A person who is receiving month-to-month Social Safety or RRB benefits, a minimum of 4 months before turning age 65, does not need to file a separate application to become entitled to premium-free Part A. In this situation, the person will get Part An automatically at age 65. An individual that is not receiving month-to-month Social Protection or RRB benefits must file an application for Medicare by getting in touch with the Social Security Management.

If the application is submitted more than 6 months after turning age 65, Component A protection will be retroactive for 6 months. For an individual whose 65th birthday celebration gets on the initial day of the month, Component A coverage starts on the very first day of the month preceding their birth month.

Individuals who should pay a premium for Part A do not instantly obtain Medicare when they turn 65. They need to: File an application to sign up by speaking to the Social Safety and security Management; Enroll throughout a valid enrollment period; and also Likewise register in or already have Part B. To keep costs Part A, the person must continue to pay all regular monthly premiums as well as stay signed up in Component B.

Premium Part A coverage begins protection month following the complying with of enrollment.

There is no waiting duration. SSA rules do not permit kid disability benefits to start earlier than age 18. Consequently, Part A privilege based on youngster disability advantage entitlement can never begin prior to the month the person attains age 20 (or age 18 if the person's handicap is ALS).

Examine This Report about Paul B Insurance Medicare Advantage Plans Huntington

The third month after the month in which a normal program of dialysis starts; or The initial month a normal program of dialysis begins if the specific participates in self-dialysis training; or The month of kidney transplant; or more months before the month of transplant if the person was hospitalized during those months in prep work for the transplant Individuals already getting Social Safety or RRB benefits at the very least 4 months prior to being qualified for Medicare and also staying in the United States (except citizens of Puerto Rico) are instantly enlisted in both premium-free Part An and find out here now Part B.

Individuals living in Puerto Rico who are eligible for automatic registration are just enrolled in premium-free Part A; they must actively enlist partly B to get this protection. People that are not obtaining a Social Safety or RRB benefit are not immediately enrolled. People who previously declined Part B, or that terminated their Part B enrollment, might enlist (or re-enroll) partly B just throughout particular enrollment durations.

Component B is a voluntary program that calls for the payment of a monthly premium for all parts of coverage. Eligibility guidelines for Component B depend upon whether a person is qualified for premium-free Component A or whether the person needs to pay a premium for Component An insurance coverage. People that are qualified for premium-free Component A are additionally qualified for enroll partially B once they are entitled to Part A.

All About Paul B Insurance Medicare Agent Huntington